I often compare the financial services industry to the world of diet and fitness. In fact, I wrote a blog about it here last year. Parts of both industries seem to share an obsession with selling quick fixes and easy answers to long term, difficult challenges.

But, what about a more direct comparison? Is there a direct relationship between physical and fiscal health? Is there more incentive than a slimmer waistline and a new pair of jeans to getting in shape and staying fit? Sure, the health benefits should be motivation enough, but virtually any behavioral data available suggests they are not.

The short answer is there’s most definitely a relationship and the cost savings are more important than ever. If you look at the way inflation impacts our society, health care costs lead the way, meaning it costs you more each and every year to provide you and your family with the same level of care. A healthier you could mean lower health & life insurance premiums, fewer days off work, lower food costs and reduced costs associated with nursing care and assisted living down the road. The list can go on and on.

Is it a guaranteed cure all? Of course not, but the reduced physical and mental stress to your body & mind over time alone should make it worth the effort.

Nothing I’ve said is earth shattering news, so where do we get off track? In part, it’s the way we think about nutrition and fitness. As kids, we “go outside and play” or go to “recess”. Adults refer to “working out” or “doing yard work”. Kids typically snack as a way to grab a quick, healthy snack to refuel before more play. Adult snacking becomes something we do with one hand reserved for the remote control while the other is stained orange from a food-like substance known as the cheese doodle.

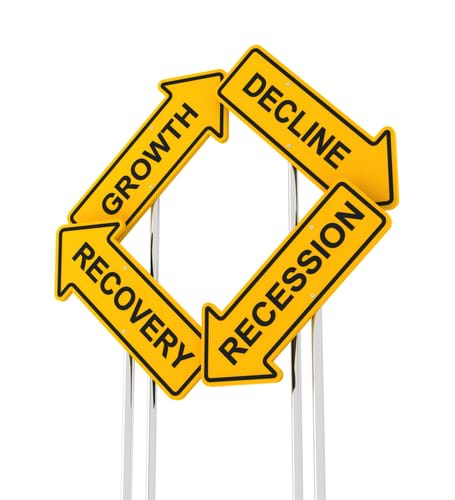

The comparison to fiscal and physical fitness extends beyond cost savings. In fact, putting a plan together to stay as healthy as possible carries many of the same rules of thumb as a financial plan. Let’s look at some specifics . . .

Start today, not tomorrow

Compounding works in many areas of life. Many of you know that the earlier you start saving for the future, the easier it is to meet your goals. The costs to waiting are high. Same goes for your physical health. Quitting smoking today? Better than tomorrow. Starting to take a daily walk today versus waiting until Monday. Better. Every little bit helps and the more you do immediately, the less painful it will be.

Diversify

One of the biggest reasons people burn out or never get going with an active lifestyle is the perceived boredom. Just as sticking all your eggs in one asset class or investment is a surefire way to fail in investing; there can more to a healthy lifestyle than a treadmill or stationary bike. Diversify your activity and you’ll be much more likely to stay engaged and succeed. There’s any number of ways to do this including CrossFit, Zumba, Yoga, and Tai Chi. Many community center and gyms are offering an ever-increasing array of classes. Challenge your body in different ways and keep your mind engaged by turning your training into true cross-training.

Do it with Purpose – Make a Plan

Too often, people choose investments without any real consideration as to whether it is appropriate for them or what role it plays in meeting their goals. Much the same, putting a diet together based on a two minute TV clip or walking into a fitness facility and trying to figure out the machines without a sense of your ability to tolerate the physical exertion is a poor choice. Checking first with your doctor and spending an hour or two with a personal trainer can go a long way in jump starting a successful plan.

Stay Low Cost

Costs matter, but shouldn’t be an excuse. You don’t have to spend a fortune to stay fit. If you have nothing to spend on your physical health (read that again and see if it makes sense to you), there’s still plenty you can do with your own two feet and your body weight to stay very healthy. The internet is a valuable tool for researching various ways to build a program with little to no equipment at all. Besides, with all the money you’ll save by eating less, and cutting back on health care costs, how can you afford not to get started?

Perhaps the biggest link of all is to manage your expectations. If you expect mind-blowing results without the work, it’s no different than expecting reasonable investment returns without any meaningful contributions or planning. It’s just not the way life works. Focus on those things you can control and don’t sweat minor setbacks from time to time. In fact, make a point to celebrate even small milestones as a way of stoking the fire towards more progress. Just make sure you find a way to reward yourself that doesn’t mean overindulging, or you’ll be right back where you started.